A Brief History of Startups in Nigeria: Part One

The mavericks who built the fastest-growing tech ecosystem in Africa.

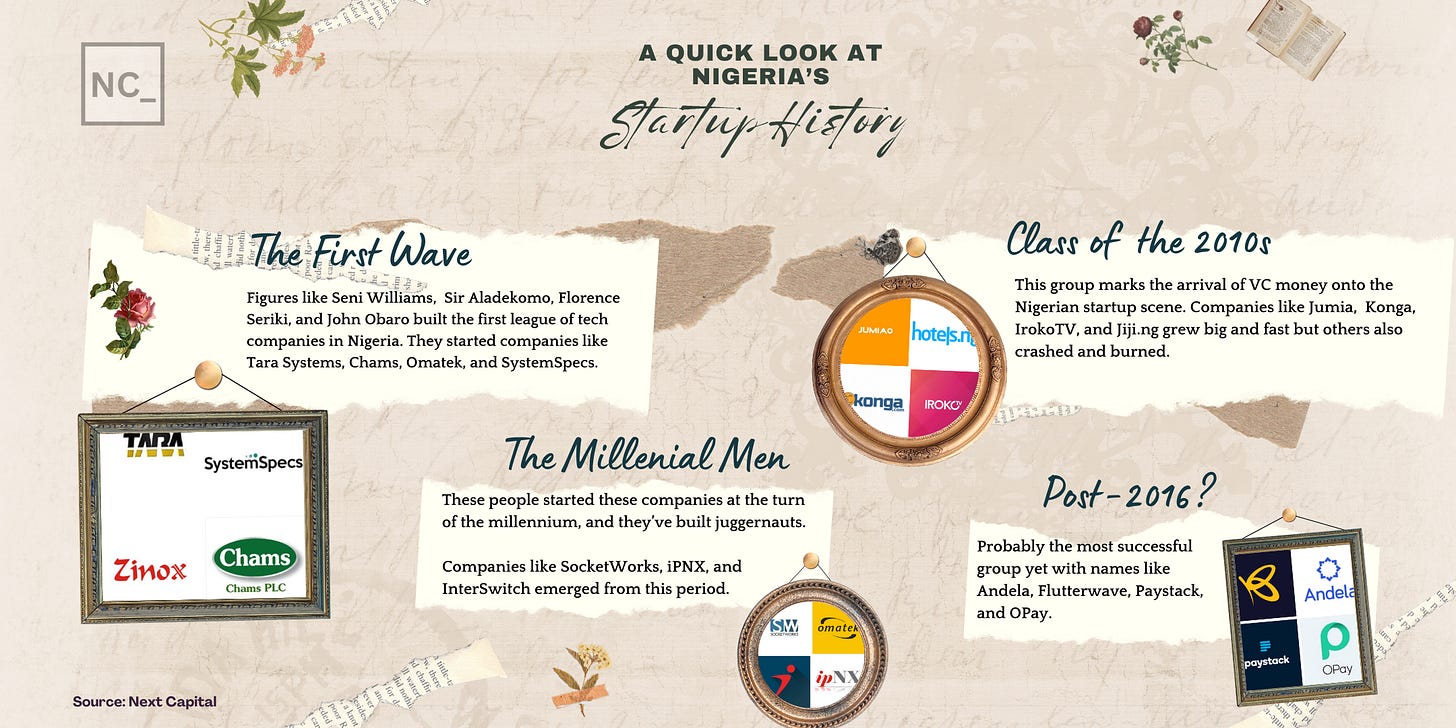

Paystack sold to Stripe for $200m in 2020, putting Nigerian tech on the world map. But Nigerian startup history stretches far beyond 2020. It is about 30 years old, and just like every other thing, it has a story.

Today’s article will try to tell the first half of that story in five minutes. It’s a long one, but it all starts with a company named Tara Systems.

The First Wave — featuring Tara Systems

As far back as 1994, while Nigeria exported crude oil, we also exported software. One of the major companies leading the charge was a software outfit named Tara Systems, led by Seni Williams.

Tara Systems developed a software called Microbanker (or AutoBank), which was used across most banks in Nigeria and even in many American banks. The company hired many developers and created software on par with what could be found in many parts of the world.

It’s the earliest version of what we now call a software startup today in Nigeria, and it was pretty successful. At one point, over 800 banks in the US and many others in Europe used the software.

SystemSpecs

Unless you live under a rock, you’ve probably heard of Remita. It’s the same payment gateway you use to pay your school fees if you’re a student, your passport application fees if you’re a regular citizen, and pretty much anything else that involves giving the government some of your cash over the Internet.

What’s more interesting is the history of the company behind it— SystemSpecs.

John Obaro founded SystemSpecs in 1991, and it was a software reseller focused on selling to organizations. It started as a 5-man team that resold accounting software developed by SunSystems in the UK.

A few years later, the company developed its payroll software, HumanManager, written in COBOL. Yeah, for context, Javascript wasn’t invented until 1995. By 2004, HumanManager passed a world-class quality assurance test and was dubbed Nigeria’s most successful software yet. But the buck didn’t stop there for SystemSpecs.

Remita, another blockbuster from the company, got its start as a project carried out with the World Bank to manage payroll for the Federal Government of Nigeria. The pilot study was carried out on 50,000 workers, and needless to say, it was very successful. Remita allowed individuals, businesses, and organizations to view their account balances across different banks and manage multiple payment channels.

This sounds like something out of FinTech 2.0 in Nigeria, but Remita had already done this in 2005. In 2012, the government decided to unify all its accounts into a Treasury Single Account (TSA), where all payments in and out of the government were to be made. One thing it needed was a payment gateway, and it chose Remita to fill that gap.

Today, Remita processes over $50bn annually and takes a 1% cut on all transactions that flow through its payment gateway. SystemSpecs itself is worth hundreds of millions of dollars, and that’s being very conservative. In many ways, SystemSpecs laid the groundwork for the wave of startups that hit Nigeria in the 2010s and beyond.

SocketWorks

SocketWorks is another important company in Nigeria's startup history. A former director at Apple, Dr. Aloy Chife, founded the company in 2002. The company was initially going to provide software services to Nigeria’s oil and gas industry, but it pivoted to digitizing government systems after raising $2.5m from the International Finance Corporation (IFC).

If you’ve ever signed up to get a passport or attended a Nigerian university, chances are, you’ve unknowingly used SocketWorks. The company digitized most government agencies and exports its software to many other countries. Sometimes, as far as Sri Lanka.

The Hardware Boys

This part of the story is sarcastically titled “The Hardware Boys” because the hardware revolution in Nigeria was, in fact, started by a woman. Ever heard of Omatek? It’s a brand of locally assembled computers started by Florence Seriki in 1993.

The company was the first in Africa to manufacture and assemble computers and computer components like cases, keyboards, and even servers. The company was an official partner of Compaq, and it imported components that were then assembled and branded for sale to local companies.

In many ways, she sparked a hardware movement that culminated in the famous Otigba Market (computer village) in Ikeja, which generates about $2bn in sales annually.

Also worthy of mention is Zinox Computers, started by Leo Stan Ekeh. Zinox was basically like Omatek, except that they were focused on selling to customers, as opposed to businesses alone. While Omatek focused on assembling computers only, Zinox was a full-range hardware technology company, developing generators, tablets, and even solar products.

Zinox became popular in the mainstream tech ecosystem when it acquired 99% of Konga in 2018, but it’s been a huge player long before then. Recently, the company announced that it’d be investing $250m into developing energy solutions for the Nigerian market over the next ten years. It’ll be fun to see how that pans out. But if their past success is anything to go by, I’d say “watch this space”.

Chams Plc is another interesting company in the history of Nigeria’s computer revolution. Fun fact: Chams is short for Computer Hardware and Maintenance Services. Sir Demola Aladekomo started the company in 1983 from his one-bedroom apartment in Surulere, where he initially did hardware maintenance for companies in Lagos. Eventually, the company moved to its first headquarters in Ikeja and pivoted to providing identity management solutions to the government and private organizations. Today, the company has operations in mobile money, payroll management, and smart chip technology, and it is listed on the Nigerian stock exchange.

There are many other interesting startups from this phase, like Interswitch, iPNX, eTranzact, Swifta, CWG, and many others, but this article is but a brief history.

Up next: Nigerian Startups — Class of The 2010s.

The Second Wave — Of Spaceships and Iroko Trees

It’s hard to tell when the second wave of startups in Nigeria began, but it’s safe to say it started when Rocket Internet discovered Nigeria. Rocket Internet was started by the Samwer Brothers, a group of sibling entrepreneurs from Germany. They first made their money by building copycat versions of successful US startups and selling them very quickly.

They first did this with an eBay copycat, which they started in Germany and sold for ~$40m within the first 100 days of launch. And who did they sell it to? eBay. They did this with many other companies like Groupon, Zappos, and many others. Then, they started investing in copycats in 2007 when they started Rocket Internet. They invested in companies like Soundcloud, StudioVZ, Readmill and many others. Today, Rocket Internet has made more than $4bn.

But why is this story relevant? Because that’s exactly how Jumia got its start.

In 2012, Jeremy Hodara, Tunde Kehinde, and a few other folks started Jumia with hopes of building it into the Amazon of Africa. They had the smarts, and Rocket had the cash. But neither of those was enough. Rocket Internet invested $800m+ into the company over a number of mega-rounds that spanned seven years.

Between the rollout of JumiaPay, Jumia One, two economic recessions (overseen by the worst Nigerian president in recent memory), and fierce competition from Konga, Jumia finally went public on the New York Stock Exchange in 2019. Its market cap at the end of its first day on the market was over $1.5B. Today, it trades around $400m, and Rocket Internet exited its stake in Jumia at a loss.

But Jumia wasn’t alone. It had classmates. Many of them, in fact.

There was Konga, which Sim Shagaya started after he’d exited Dealdey, a daily deals website. Konga was the real contender to Jumia in the Nigerian market, and it once raised $75m at what was rumoured to be a $200m valuation. Things were great until the recession hit in 2016. It stumbled for the next three years and was later sold to Zinox Technologies for about $32m. It was not the worst outcome in the world, but a far cry from where it seemed to be headed at the time.

Another popular classmate is IrokoTV. Started by Jason Njoku and Bastian Gotter in 2011, it quickly grew into what was dubbed the Netflix of Africa. The startup was a subscription-based streaming service for Nollywood movies. But as Jason has alluded to multiple times on his personal blog, PayTV is brutal in Africa, and he’s had to bring the company back from the brink of death a number of times.

Recently, he tweeted about a near-death experience for the company in his usual candid tone, giving a sense of where the company might be headed.

Many other startups came out of this set. Companies like Autochek, Jiji.ng, OLX, Efritin, and many others were a part of this wave, but the story doesn’t end there.

The next wave is probably the most interesting one yet. It features a few unicorns and the biggest exit we’ve seen in recent times, but that’s a story for another episode. Stay tuned for it.

Other stuff I’m currently reading

Entrepreneurship in Africa: A Study of Successes by David Fick

Entrepreneurial Hustle and the Rise (and Fall) of Personal Computer Companies in Lagos, Nigeria: 1960–1999 by Kanyinsola Obayan (Ph.D)

The Otigba Computer Hardware Cluster in Nigeria by Banji Oyelaran-Oyeyinka

The Fintech 2.0 Paper: Rebooting Financial Services by Oliver Wyman

What did you enjoy about this article? Share your thoughts in the comments!

I enjoy your excellent recap of those eras. Thank you for adding a reference.